Share trading

as a concept rooted in India long before its Asian peer’s and as a matter of fact

earliest records of share market went back to 200 years with the East India Company.The Bombay Stock Exchange,the oldest exchange in Asia,traces its history to the 1850s, when four Gujarati and one Parsi stockbroker would gather under banyan trees in front of Mumbai's Town Hall.

Indian markets have their own share of Ups and Downs and are known to be volatile. There however are many interesting trend that have driven the markets. A few of them so punctual in there occurrence that they are hard to ignore and their reasons hard to justify.

Due to their historical appearances some of these trends have become a

governing phenomenon for e.g. Technical analyst use Fibonacci retracement ,

which was earlier an observed trend have now become a tool for traders to set

their trades. One of this long term trends is the ‘Cycle of 8’

The cycle of 8

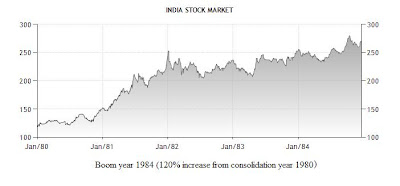

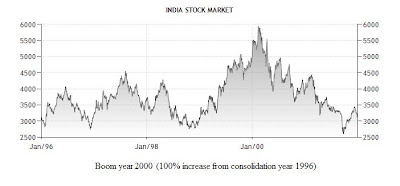

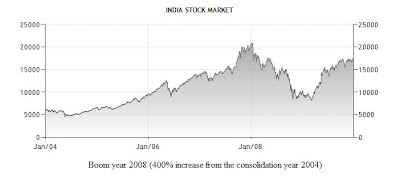

is a long term trend that has governed the booms in the Indian Markets. The

trend started in 1984 and from then on cycle of Eight years has repeated itself religiously total 4 times. The consolidation in each period during this cycle has started 4

years before the actual boom year.

Boom

Year growth from 4 year back

1984 First bubble 120%

1992 Harsha Mehta 500%

2000 Dotcom bubble 100%

The cycle points to 2016 as the next boom, it may appear a distant future as of now, but the consolidation year has come and by the logic of it Investments have to be made now in a systematic manner if not one time.

The hypothetical graph on the side have been drawn considering the lowest of returns among the above stated boom years, actual could be much higher considering the way economy is growing. So this is the time to tap the low valuations and wait for the profits to ripe